These specialized services help agencies maintain financial stability while navigating the unique challenges of the marketing industry. Understanding and effectively managing these metrics is crucial for agency growth and sustainability. They provide insights into operational efficiency, profitability, and areas for potential improvement.

- Our specialty is providing small business owners nationwide quality accounting, bookkeeping, payroll and tax services they need.

- A robust collaboration framework ensures seamless alignment between agency execution and firm objectives.

- It’s a document that outlines the services provided in addition to the quantities, prices, terms of payment, and other relevant details.

- By not tracking billable expenses your agency runs the risk of failing to be reimbursed for costs that should be paid by clients.

How to Choose the Accounting Software That’s Right for Your Marketing Agency

It helps agencies more quickly spot any errors or irregularities while guiding them toward potential enhancements. By leveraging financial data effectively, agencies can drive strategic growth. These platforms offer functionalities that help manage complex billing and revenue models. This connectivity enables a unified view of agency operations, from finances to project management.

Why Accurate Bookkeeping is Vital for Marketing Agencies

- For projects that bill by the hour, you need to implement a timekeeping system that allocates contractor and employee time to client projects.

- By analyzing cash flow patterns, agencies can identify potential issues or opportunities, such as periods of high expenditure or irregular income.

- The best way to to track billable expenses is to immediately note the expense in your accounting system as a billable expense.

- For example, you would be able to see how a client missing their payment due date will impact your cash position.

By having a comprehensive forecast of your revenue and budget for expenses, you can make informed decisions about how to allocate your resources and avoid financial issues in the future. As you plan your agency’s financial future, it’s important to also generate financial reports that track your progress and help you make informed decisions. When it comes to managing your agency’s cash flow, it’s crucial to have a clear understanding of your financial situation. This means forecasting revenue and budgeting expenses accurately and regularly. Without these two key elements, you may find yourself in a precarious financial situation that’s difficult to recover from. Worse yet, inaccurate bookkeeping can lead to legal issues, such as tax audits or lawsuits.

Best accounting software for a marketing agency

Accounting for advertising agencies requires breaking down income into clear categories like retainer fees, hourly rates, project-based fees, and performance-based bonuses. This granular approach helps you assess the profitability of each client and service. On the expense side, keep separate categories for employee salaries, software subscriptions, advertising costs, etc. Remember, accurate categorization is crucial for meaningful financial analysis. Utilizing tax services tailored for marketing agencies offers several benefits.

If your client data lives in a CRM or project-management software, which you also use for invoicing, then you don’t accounting for marketing agencies need to duplicate data between the two systems. You should still sync basic clients and invoices between software, if possible, but you can get by with syncing as little information as possible. If you use any third-party apps, such as timekeeping or payroll software, you should connect it to your accounting software.

For accounting firms looking to maximize their social media impact while focusing on their primary business operations, collaborating with a social media agency can provide significant advantages. A strategic partnership with the right agency creates a powerful combination of industry expertise and digital marketing prowess. Generating financial reports can provide a clear picture of your agency’s financial health, allowing you to make informed decisions and plan for the future. Forecasting revenue and analyzing profitability are crucial components of financial reporting that can help you understand your agency’s performance and identify areas for improvement. By reviewing financial reports regularly, you can gain insights into your contra asset account agency’s financial performance and make informed decisions that can positively impact your bottom line. Expert financial management plays a crucial role in the success and longevity of marketing agencies.

- Tracking your agency’s income and expenses is like keeping a detailed map of your financial journey.

- We invite you to take a look at the different kinds of businesses, organizations, and industries we service to gain a better sense of how Profit Line can help you on your path to success.

- This also improves budget tracking (more on this below), as users can tag project-related charges and ensure all costs are accounted for.

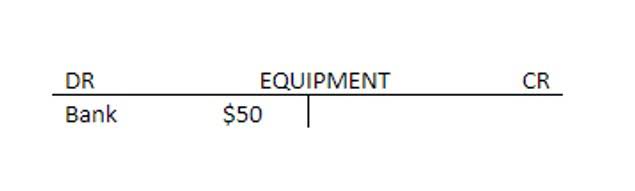

- A deficit on either side of the column indicates an imbalance of either revenue or expenses, meaning you have a more accurate idea of your ROI for business expenses, total revenue, etc.

- Success on social media requires strategic engagement and growth initiatives that go beyond basic content creation.

Using Financial Data to Make Informed Decisions

So, whether you’re a seasoned marketer or just starting out, read on to learn how you can take control of your finances and set your agency up for success. Accurate and timely reporting is essential for marketing agencies to understand their business financial position and make informed decisions. A CFO can help agencies develop customized reports, analyze the data, and provide insights into their financial performance. This can include monitoring key performance indicators HVAC Bookkeeping (KPIs), identifying trends, and the agency campaign’s ROI. However, even the most dazzling campaigns can’t shine without strong financial footing.